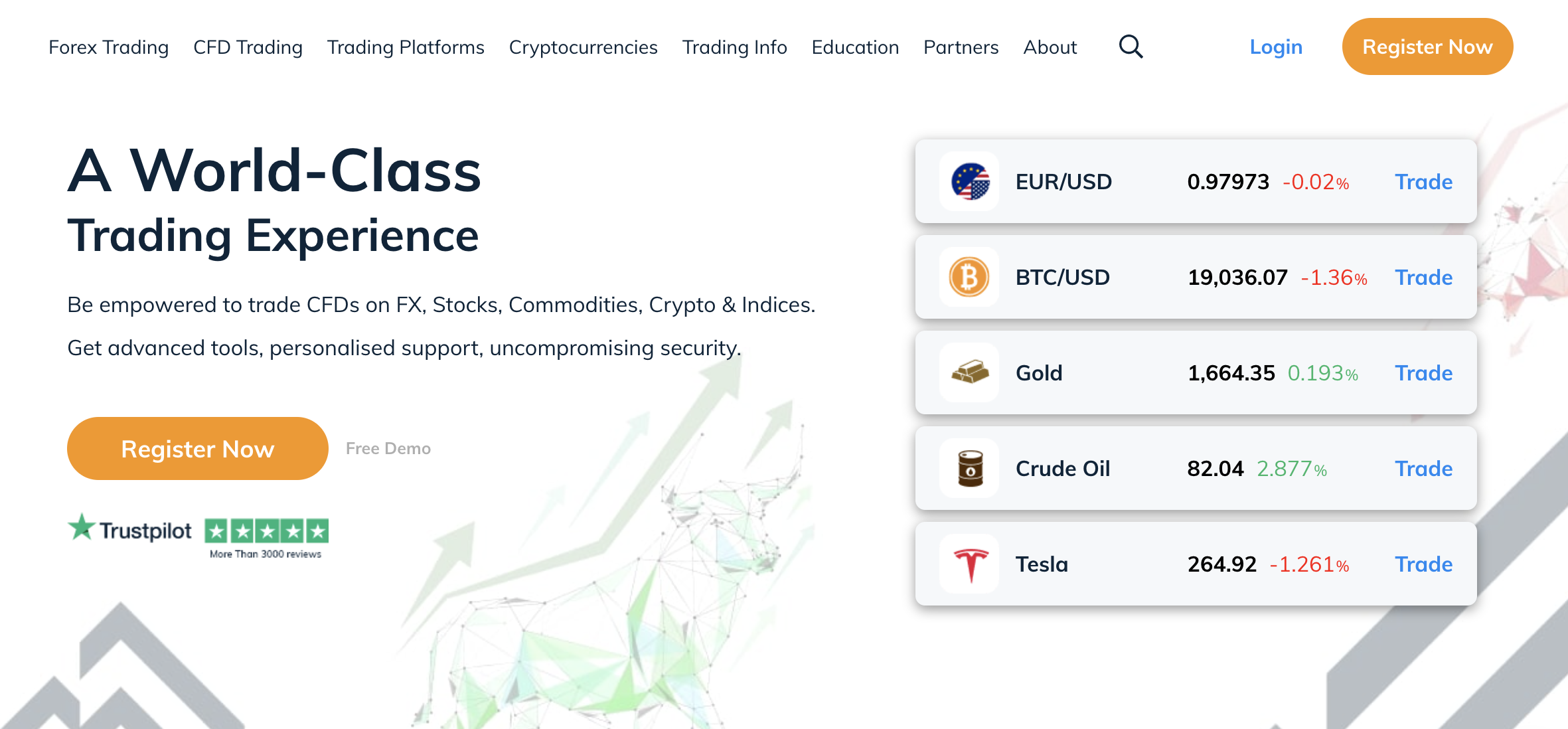

AvaTrade review: Should you sign up or not? – Broker test for traders

- Regulated broker

- 1,000+ Markets

- Professional platforms

- Free demo account

- Low fees & Raw spreads

- High leverage

With the increasing range of online brokers, it is becoming more and more difficult to find a good one. After all, they all offer different conditions, fees, and assets that can be traded.

Therefore, especially for experienced traders and those who want to get serious, it makes sense to compare brokers with each other. In this review, we took a closer look at the online broker AvaTrade. You can find out why the broker is so solid and why we gave it a decent rating in this overview.

What is AvaTrade?

AvaTrade is a global and trusted brokerage firm that won plenty of awards during the last years. They offer its traders in-house information and educational materials that go a long way for them, no matter their status. As a long-time provider of digital assets, the company has a well-advanced technological interface. Its interface is user-friendly, allowing users to have a good trading experience.

Besides, AvaTrade is a well-known and globally trusted forex broker. The company started operating as far back as 2006, making it one of the oldest brokers to exist. Not only is the broker known because of how old it is, but AvaTrade has recently partnered with Manchester City in recent years. Manchester City is a popular English football club.

Regarding the trading platform, AvaTrade has more than 1000 tradable assets that traders can use to perform transactions. The broker also has an MT4 and MT5 trading platform. Besides these two platforms, other platforms make the broker well patronized by clients.

AvaTrade happens to have different offices around the world. These offices are, of course, under regulation to ensure the broker performs duties transparently and truthfully. AvaTrade has its headquarters in Ireland – Dublin. With a moderate minimum deposit and friendly trading platform, most traders like to use this broker.

Is AvaTrade under proper regulation?

AvaTrade is under proper regulation. Regulations are what prove that a broker is internationally or locally supervised. Regulations are necessary because they help the trading platform prove that they are not a scam. Since AvaTrade is under regulation, this is proof that the broker is not a scam.

The forex broker’s company is under the regulation of international licensing bodies. These licensing bodies are charged with supervising financial organizations or financial providers. These international licensing companies that supervise AvaTrade include the Central Bank of Ireland (CBI), ASIC, a financial regulator in Australia, FSC, a regulator from South Africa, FSCA, ADGM, and ISA.

As a result of these financial regulators, the AvaTrade platform is designed to protect security for traders. Protecting the rights of every trader on the platform is one of AvaTrade’s aims as an internationally recognized Forex broker. Traders can trade knowing that their funds are safe because of the availability of these regulators on the broker.

Review of AvaTrade’s trading offers and conditions

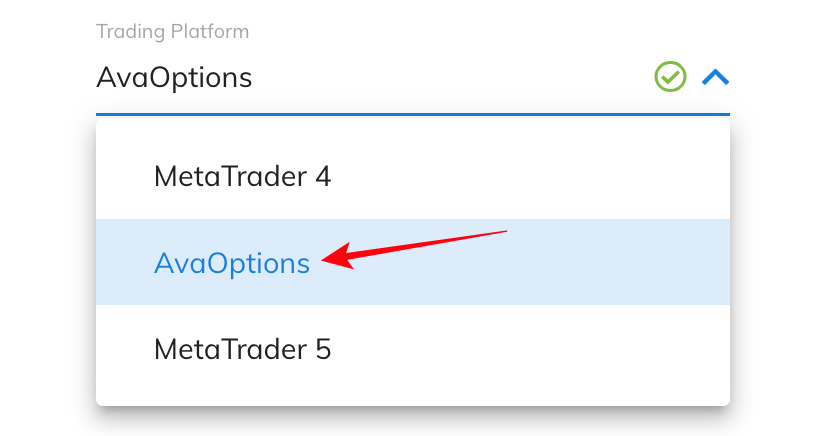

Trading platforms

- MetaTrader 4

- MetaTrader 4

- WebTrader

- AvaOptions

- AvaTradeGo (App)

(we will go into detail about each platform later in this article)

This broker has a lot of advantages to using its trading platform. You will receive a cash bonus at the first instance of creating your account, which you can use to make trades. AvaTrade provides its clients with MetaTrader platforms. These platforms are known to be advanced in technology and able to perform multiple functions.

Besides having the ability to use the MT platforms, traders can trade with other available platforms on their phones and desktop (WebTrader, AvaOptions, AvaTradeGo). AvaTrade platform has good usability. The interface is designed in a way that allows traders to navigate smoothly. Every clickable button is designed visibly.

Traders on the platform can access the assets that it provides. These assets and the traders have many choices to make when it comes to picking the right asset to add to their portfolio. Lastly, this broker provides copy trading for traders. Copy trading is a great tool that allows a trader to copy the exact trading strategy of another trader.

Account types for the broker AvaTrade

Unlike most traders, the broker doesn’t have many account types. However, the account types available are made to suit every trader out there. To select the account type of your choice on the AvaTrade platform, you must create an account with them. Creating an account with them means signing up with the broker.

After signing up, your account must be verified. This process should only take a day. The account types are like plans. One can make different deposit amounts into the accounts and other benefits. Before selecting an account, make sure you go through the account details.

Account types available on AvaTrade include the following:

- Demo account

- Standard account

- Swap free or Islamic account

- Professional account

Demo Account

The demo account is, as the name suggests, simply a simulation account. It is designed to help newcomers know how to trade on the platform. Being a newcomer to a forex trading platform might be confusing, so the demo account is here to guide you through the interface, how to trade and how to do other necessary things on the platform. The demo account is very useful, and even professional traders still make use of the account.

Standard Account

The standard account is like the starting account. The account is great for traders who are new to the platform. It comes with many benefits, like having the lowest minimum deposit. Standard account owners can deposit money as low as $100. This is the starting amount of deposits for these account owners. The spread is tight, and the users enjoy a reasonable amount of leverage 1:400.

Swap Free Account

Knowing that Islamic states’ trading and market rates are different from the normal trading rate, AvaTrade provides a trading account just for Islamic states. Swap accounts offer enough benefits for those in Islamic states, like lower trading fees, especially overnight trading. The swap account offers the same number of assets as the standard account.

Professional Account

The professional account is mainly used by experts. Any trader does not just use a professional account. To have this account, traders need to request an account from AvaTrade. It is upon receiving the request that traders can use the account. This account has a higher minimum deposit for the traders, but it also comes with a tighter spread and higher leverage.

Financial assets available for trading on AvaTrade:

This broker platform may not offer as many assets as most competitors. However, they have enough assets for traders to trade with. The assets have good leverages, and the spread for most assets is very reasonable. On the trading platform, you can surely diversify your portfolio with the different assets, which will be mentioned below.

- Forex

- Cryptocurrencies

- Commodities

- Stocks

Forex assets on AvaTrade

Forex involves the exchange of different world-leading currencies. This is a very popular trading asset available on the platform. Available on AvaTrade is more than 50 FX currency pairs. Forex assets can be traded overnight – this means that you can trade forex 24 hours every day. Leverage for each currency pair varies and has a spread of 0.8 pips. Forex trading is very easy on the platform.

| Forex pairs: | 50+ |

| Leverage: | Up to 400:1, depending on currency pair and country of residence. Up to 30:1 for traders from Europe |

| Spreads: | Starting from 0.8 pips |

| Execution: | Instant |

| Availability: | During stock exchange opening hours |

Cryptocurrency assets on AvaTrade

There are not many cryptocurrencies available on AvaTrade. The broker offers only up to 8 tradable crypto assets. These assets include the following – Bitcoin, Ethereum, and Ripple, to mention a few coins. For traders who are in Canada and the UK, cryptocurrencies are not available for them. This limits the trading experience for traders in these regions. Those who can trade crypto are offered leverage of 20:1, and the spread is tight.

| Cryptocurrency assets: | 8+ |

| Leverage: | Up to 2:1 for clients from Europe |

| Spreads: | From 0.2% over-market |

| Execution: | Instant |

| Availability: | 24/7 |

Commodity assets on AvaTrade

Commodities are one of the assets available for trade on AvaTrade. Traders have access to different commodities. The most common commodities traded on the platform are Oil and Gold. Traders have the possibility to trade with leverage and enjoy the tightest spreads for commodities on AvaTrade.

| Commodity assets: | 18+ |

| Leverage: | Up to 10:1 for clients from Europe |

| Spreads: | From $0.0015 over market |

| Execution: | Instant |

| Availability: | During stock exchange opening hours |

Stocks assets on AvaTrade

Stocks are also available on AvaTrade. This is a sign that traders can diversify their investment portfolios. Stocks are really good investment assets. Adding one of the assets to your portfolio will surely be a plus. They also offer a tight spread and one of the best levers for traders.

| Stock assets: | 250+ |

| Leverage: | Up to 5:1 on stock CFDs for European clients |

| Spreads: | From 0.13% |

| Execution: | Instant |

| Availability: | During stock exchange opening hours |

Trading fees on the AvaTrade platform

The trading fees on AvaTrade are obtained from the spreads the broker gives on every asset. This makes the fees somewhat reasonable. Charges are put on traders who open markets or take trading positions overnight. Besides the spread and overnight trade fees, traders are also charged for holding accounts with different currencies.

Traders are charged an amount while their accounts are not in use. This fee is called the ‘non-trading fee.’ At least $50 is deducted from your trading account if you fail to log in to it for over a month. If you want to bypass this fee, the best you can do is constantly login into your account, even if you do not perform trade.

Fees are, however, not charged for deposits and withdrawals. This means that you will not be charged a dime for making deposits into your trading account. The same goes for withdrawing money from your trading account. The broker will surely not charge you for doing so. This is one of the benefits that come with using the broker.

| Fee: | Information: |

|---|---|

| Swap fees for overnight open trades: | If the trader holds the position over an entire weekend, he will be charged a 3 day swap fee. It is usually charged on Wednesdays. |

| Management fees: | No management fees. |

| Inactivity fee: | Ava Trade charges an inactivity fee of $50 for not logging into the account for three months. After not logging in for twelve months, the inactivity fee is $100. |

| Deposit fee: | No deposit fees. |

| Withdrawal fee: | No withdrawal fees. |

| Market data fee: | No market data fees. |

Test of the AvaTrade trading platforms

AvaTrade packs enough platforms to make trading very comfortable for the traders. To make easy and fast transactions, this broker has different platforms from which the traders can choose. The platforms offer traders the same number of trading assets. Besides these assets, the platforms are all user-friendly.

Here’s a list of the platforms on AvaTrade:

- MetaTrader 4

- MetaTrader 5

- Mobile Trading (AvaTradeGo)

- Web Trading

MetaTrader 4

This is one of the oldest trading platforms. Besides the web trader, the MetaTrader 4 is also well-known. The platform can perform more than one task, allowing the trader to do more than one thing. For example, while trading with a particular asset, the trader has the potential to trade with another asset.

MetaTrader 5

MetaTrader 5 is another platform that permits multifunctional activities. The MT5 is even more advanced than the MT4 in certain ways. For example, this platform has more technical indicators than the MT4, allowing trade activities to be easier and faster. The MetaTrader 5 platform has easy usability because of the UI design.

Its chart is customizable, and trading position lines can be drawn.

Mobile trading

Just in case you prefer comfort and trading flexibility, the mobile trading platform is a great platform for you. Traders can perform the same trade with the web trading platform. Available on the mobile trading platform is the MetaTrader 4 and 5 platforms. These additional platforms with mobile trading make trading even easier than normal.

The platform is very much interactive, and traders can execute trades in fast order. To access this platform, you must download the application from the play store or Apple’s Appstore. There are over 90 indicators available for traders use.

Web Trading

Web Trading has been in existence for a long time now. This platform is used when you download the desktop application. On the web trader, MT4 or MT5 are also downloadable, making trading executions very easy. The web trading platform is easy to understand and navigate through. The chart is customizable, allowing traders to choose a theme with which they can easily plan a strategy.

No matter the platform on AvaTrade, you can use copy trade technology. On all the platforms, traders will have copy trading features on them. The platforms also have other tools, such as a calculator, which helps you make quick conversions.

How to trade on the AvaTrade platform

You can trade on this broker’s platform by deciding to use any of your devices since the platform is available on the web, mobile devices, and your desktop. This is a plus to AvaTrade platforms. Starting an account is the first thing to do with the broker. To start your account, you must sign up on their website or the app. Put in your information.

After putting in the necessary information, you will access the platform’s demo account. The demo account is the first learning tool AvaTrade will give you to trade on the platform. The demo account works like the real account, only that no risk is involved. Therefore, you can make trades as you wish. The profit or loss on this account is not real.

However, if you decide that you want to start trading with your real account, then you must verify your trading account. After verifying your account, you will have access to your live account. You may check how to trade on AvaTrade’s educational resources if you wish. If not, then you can proceed to deposit money into your account.

After depositing money into your trading account, you can select your preferred asset. At least AvaTrade offers a range of assets for traders to choose from. The assets are at different spreads and leverages. Include the assets you desire in your trading portfolio. After this, you open trades and confirm that you want to open them.

Watch your trades carefully, no matter the asset that you have chosen. Make sure you trade carefully and start earning profits from your trade. Luckily on AvaTrade, you can always return to the demo account to test out strategies and learn how to trade if you’re not so sure about your abilities.

How to trade forex on AvaTrade

As part of the tradable assets, forex is among. If you want to trade forex on AvaTrade, ensure you already have an account with the broker. If you do not, do not worry because the opening account procedure is straightforward. Within a short while, you will open the account. It is the verification process that takes time. Maximum, in one day, your trading account should be ready.

Select the account type of your choice and proceed to deposit money into the account. You can start with the minimum amount and then later increase your deposition if you like the broker’s platform. After funding your account, go ahead and select forex assets. Choose the currency and its currency pair you wish to exchange.

After doing so, enter the amount you want to use to invest and then continue. Continuing means that you confirm the trade you are about to make. Wait for the market to end; then, depending on how the market chart goes, you receive your reward or punishment.

However, if you are new to forex trading, you may consider trying copy trading. This tool is very useful. There’s no need to stress yourself when copy trading because the AI will copy and follow every trading step of the person you put it to follow. Copy trading ensures that the investor you are copying has a good track record of being one of the best investors.

How to trade options on AvaTrade

Although options trading has gained some popularity, it is only offered by a few brokers of which AvaTrade is one of them. There is a specially designed platform where traders can trade options on AvaTrade called AvaOptions. It is a well-designed and intuitive platform. You can set up the assets that you want to trade as well as the strategy you want to use in your trading.

While there are a number of things to love about AvaOptions, the platform cannot be customized by traders. This implies that there are some things that you will not be able to do or change on the platform. For instance, in various sections on the platform, you cannot change the platform layout or the size.

The login process on the AvaOption is one step and there is also the option to set up two-factor authentication to ensure your account is secure. There is a list of options and strategies for trading which you can select from, you can also make use of the search function to find assets by name.

How to trade cryptocurrencies on AvaTrade

As seen above in the available assets on AvaTrade, Cryptocurrency is not the broker’s fort. AvaTrade does not have a wide range of cryptocurrencies, but traders can still make trades with the available ones. Trading crypto will also require you to have an account with them and verify the account.

Afterward, you can select the coin of your choice and invest in it. Open a trade. Unfortunately for cryptocurrencies, not all clients for every region have the opportunity of being able to trade with them, further limiting the availability of crypto even more on the platform.

Overnight trading is available for those regions that can trade the asset. You can learn more about trading cryptocurrencies on the broker’s platform by practicing with your demo account and checking out the materials. Don’t forget that social copy trading is available on the platform. If you don’t know how to trade crypto, you can use the copy trade tool on the broker.

How to trade stocks on AvaTrade

This follows the same simple process. You should, first of all, have an account with the broker. Having an account with the broker gives you access to the platform’s multiple trading assets, including stocks.

Adding stocks to your investment portfolio is a great idea for diversification. After opening the account, select the stock you want to invest in. After selecting the stock, you can proceed to open trade on the stock market. AvaTrade traders can trade with more than one type of stock asset using the MetaTrader available on the platform.

Using your demo account also counts here. You can use it to learn how to trade stocks on the platform. You can also use it to plan strategies you want to use in your real account.

How to open your trading account on AvaTrade

Opening your account on AvaTrade is quite simple. Here let’s show how you can open your trading account on AvaTrade with the easy steps you can follow.

Step 1 – Sign-up on the Platform

You must go to the official website when you sign up on the platform. If you have the mobile application on your android or your IOS also, click on the sign-up button. You will be on a page requiring you to enter your email address and create a password by clicking the button. The email address you want to use should be accessible because it is through the mail that you will receive information from the broker.

You may also sign up with other sign-up methods such as Facebook. You can also sign up with Google. This is to promote the fast signing up of clients on the platform.

Step 2 – Verify the account

AvaTrade will send you some more questionnaires concerning yourself to verify your account. After filling out the questionnaire, they will ask you to provide an identity card and proof of residency. This is all part of the process, so ensure that you provide authentic documents to avoid any future complications with your trading account.

Verifying your account should take a whole day. If, after a day, your account is still not ready for you to use, then you should contact the support team. You can also try logging out and back in to see if anything changes.

Step 3 – Choose the account type of your choice

After verifying your account, you will need to choose the account type you want, whether it is the standard, Swap, or Pro account. For any of them, you have to choose one. However, the swap account is only available for those from Islamic states. If you are not a client from an Islamic state, then no swap account for you.

You still have the standard account with lots of benefits and can upgrade to a professional account later on.

Step 4 – Fund your trading account

Select any payment method that will be more advantageous to you and fund your trading account. After funding it and the money reflected, you can be sure that your account is set and ready to start trading.

How to login to AvaTrade

Login into your already created account is simple as long as you remember the email used to create your AvaTrade trading account and the password for the account. You can always click on the forgot password if you cannot remember the password. Clicking on, ‘forgot password’ is a process that will help you access your account back. AvaTrade will send you a link to create a new password to the email so you can log in. However, the following steps are how you can log in to your trading account on AvaTrade.

Step 1: Click the login button

Click the available login button at the top of your screen if you’re using the web trading platform. Enter your email and your password. If you used Google or Facebook to open the account, you could still proceed to log in with either of the two.

Step 2: Start trading

When you finally log in, you can start trading on the account. If already you’ve funded your trading balance, nothing is stopping you from using it to browse.

By clicking the login button and entering your details, you will be able to access your trading account again. Always keep an eye on it because AvaTrade’s non-trading fee will still be charging you even though you’re not trading.

How to deposit money in your account

For you can start trading on your broker platform, make sure you have money in your trading account. Meaning that you have to deposit funds into your account. AvaTrade, just like any other broker, has a minimum deposit. Below are steps on how you can fund your trading account.

Step 1 – Click on the deposit button

After you must have finished the account creation procedure, including the verification process, the next thing for you to do is to deposit funds into the account so you may begin trading on the broker. To do so, you have to click on the deposit button. After you click on it, AvaTrade will present payment methods you can use to make the deposit.

Step 2 – Choose a payment method

You cannot fund your trading account if you don’t choose a payment method. This is why AvaTrade provides its traders with multiple payment methods. Making sure that you choose the one which is most convenient for you is very important. Here is a list of the payment methods available on the broker’s platform.

- Credit Card or Debit

- Wire transfer (this method is a mostly direct deposit from your bank account into the trading account)

- PayPal

- Skrill

- Neteller

Some payment methods are not available in some regions, meaning that traders in those regions cannot use those payment methods. The credit or Debit Card method is the most used and general payment method by most clients.

Step 3 – Enter the amount you want to deposit

After selecting a payment method, you will have to enter the amount of your choice. However, there is a minimum deposit that traders can add to their accounts. For AvaTrade, the minimum deposit for the account is $100. Once you have selected the amount you want, confirm the amount to proceed to the next step.

Step 4 – Start trading

By confirming the amount you want to deposit, the money you want will directly and immediately enter your trading account. This means that you are set to start trading. Start trading with any asset of your choice. You can select multiple assets to diversify your trading account with the broker.

Deposits are free on this broker, and you will not be charged any fee to fund your trading account with AvaTrade.

Withdrawal review – How to withdraw on AvaTrade

The withdrawal process with this broker varies depending on the kind of payment method that you have chosen. For example, if you want to withdraw with a direct bank transfer, the procedure will take up to 3 business days. Using your card method may take up to 6 business days. The fastest withdrawal method is using any e-wallet channel that you own. Below are steps to take to withdraw money from your trading account.

Step 1 – Click the withdrawal button

As long as you are logged in on the platform, you can start making withdrawals from your profit. To do this, you must click on the platform’s withdrawal button. From there, you can put in a figure you want to withdraw. There is a minimum amount for withdrawal that traders can make on their platform.

Step 2 – Confirm the withdrawal

After selecting the payment method and entering the amount you want to withdraw from your trading account, the next thing you should do is confirm the transaction. Depending on your chosen payment method, the money will take some time to reflect in your account. The process should be within 1-6 business days.

Customer support for traders on AvaTrade

Traders that have queries and questions to ask about the platform have access to contact the company thanks to the customer agent. Customer support is available 24-5. This means that the clients cannot reach them on weekends. If you have a query during the weekend, you will, unfortunately, be unable to reach them.

Besides the call center, AvaTrade provides other forms of support for traders. This includes the availability of FAQs for traders. FAQs are already answered questions that almost every trader has in their mind. At times they might have all the necessary information that the trader needs. Other times, it may not. The trader can look for a higher means of getting answers if it does not.

Traders, after all, also have an email to contact and an online response to contact on any social media network – for example, WhatsApp. The AvaTrade support team can be reached through any of these outlets. The support is multilingual in several languages, which will help clients communicate better with them.

Contact info – How to contact AvaTrade

- Phone number – +442033074336

- WhatsApp contact for chat support – +447520644093

Visit AvaTrade’s official website at – www.avatrade.com/about-avatrade/contact-us for more numbers depending on your language.

| Customer care number: | WhatsApp support: | Live chat: | Availability: |

|---|---|---|---|

| +442033074336 | +447520644093 | Yes, available | 24-5 |

How to learn trading with AvaTrade

You can learn how to trade with the broker’s different mediums on the platform. One of which is the most common way is the demo account. The demo account looks exactly like the live account. You can select the demo account and use it for free as a trader. Make sure you utilize the full use of this account.

The broker provides courses for its traders. The good thing about the broker is that it cares about the trader’s growth. The courses provide a detailed explanation of whatever asset you want. Except for the course, AvaTrade has a blog page that provides information about trading on the platform.

There are enough videos that traders can use on the broker to visualize how to trade properly with the broker.

In what countries is AvaTrade available?

AvaTrade accepts clients from different regions who wish to trade on the platform.

Some of the regions accepted on the AvaTrade platform include the following:

- Canada

- Thailand

- Sweden

- South Africa

- Denmark

- UAE

- France

- Nigeria

- Qatar Emirates

- Luxembourg

Clients from the following regions below cannot trade on AvaTrade’s trading platform (banned countries):

- Iran

- Belgium

- Cuba

- Syria

- New Zealand

- Iraq

- USA

- Russia

Advantages that come with using AvaTrade

The following advantages are what clients enjoy while trading on this broker’s trading platform:

- A well-regulated trading platform that protects the rights of every trader on the platform

- Offers a wide range of assets to traders on its platform

- Clients have access to educational resources that are very helpful to their growth

- The broker provides a demo account for its clients

- Islamic traders have a separate account that they can make use of

- Overnight trading is possible on all assets – crypto, stocks, ETFs e.t.c.

- MetaTrader platforms are available in both 4 and 5.

Traders enjoy these and many other advantages on AvaTrade.

Disadvantages of using the broker

The following are disadvantages that come with trading on AvaTrader:

- AvaTrade has enough asses but not enough to compete with some other competitors

- The platform sometimes lags making, reducing traders’ experience on the platform.

Is AvaTrade a reliable trading platform?

You can rely on this trading platform because of several reasons. The broker is under regulation, making it trusted. Avatrade Markets are transparent, and the tradable assets offer tight spreads. For those clients in Islamic states, they can choose an account that is specifically for them and offers favorable trading fees and conditions to them.

As a trader on AvaTrade, you can be sure of getting customer support in your language. Traders also trade on MetaTrader platforms that provide one of the best trading experiences.

AvaTrade is reliable. However, it lacks enough assets that traders can use to trade with compared to most of its competitors. Still, with tight spreads and high leverages on them, AvaTrade is somehow able to narrow the gap.

Conclusion – AvaTrade is a safe broker that offers good conditions for traders

Perhaps being an old broker, AvaTrade can improve its trading platform to provide the best trading satisfaction. AvaTrade is an award-winning broker for one of the best customer support forex brokers. The platform offers transparent trading fees to all clients, which is not a scam. This broker, over the years, has proven to be trustworthy.

Frequently asked questions about AvaTrade (FAQs):

Does AvaTrade offer a cTrader platform?

Unfortunately no, traders cannot access the cTrader platform on AvaTrade. The broker still has good trading platforms like MetaTrader, Mobile Trading, and Web Trading. They offer unique trading experiences to every client. The platforms even come with technical indicators.

Does AvaTrade offer bonuses to its clients?

Yes, clients get bonuses from this broker. The first bonus that traders receive is a welcome bonus. Besides the welcome bonus, traders also get discounts when they invite others to trade on the platform. AvaTrade has an invite your friend option, allowing traders to invite friends and families. When those people fully register with the broker, you will get a bonus from AvaTrade.

Is AvaTrade a good broker for beginners?

Yes, the broker is good for even beginner traders. The broker has an academy that new traders can access. Besides that, a demo account is accessible to the traders. AvaTrade also provides courses in the form of articles and videos, which every trader can access on the broker’s website.

Are my funds safe with AvaTrade?

Yes, your funds are safe with the broker. To prove this, AvaTrade is under the license of international regulatory bodies. These bodies ensure that AvaTrade safeguards all of its traders trading rights and their funds. The broker keeps the fund of its traders in a different account from its own. This means all your deposits and earnings on the broker are kept in a different account from the broker itself. So, as a trader, your funds are safe.

.

(Risk warning: Your capital can be at risk)