In this guide from experts, you will learn everything about trading Binary Options. We will introduce you to the basics, show you how Binary Trading works, explain to you the best binary trading strategies, and answer all questions concerning how to trade Binary Options.

Definition: What are Binary Options?

Binary Options are a financial instrument that gained the attention of many traders in the past years. You can trade on long or short markets within a defined period of time. The special thing about Binary Options is:

You have only two options as a trader.

Whether you lose all your money with one trader or you get a high, fixed payout between 75 and 95 % of your money. You bet on rising and falling markets.

As a financial instrument, Binary Options are very flexible – you can use different time periods and trade almost every asset. The time periods normally start from 5 seconds and go up to at least one hour. So you only have two possible ways to place a trade:

- Call / Higher: Your forecast is a higher future price (rising market)

- Put / Lower: Your forecast is a higher future price (rising market)

Continue reading to find out more detailed information about how to trade Binary Options. Proper Knowledge is the key to sustainable success. You also have to be aware of the risks that come along with trading a Binary Option.

(Risk warning: Your capital can be at risk)

Step-by-step guide: How to trade Binary Options

In the following section, we will show you how to trade in detail. Follow these five simple steps:

- Find a trustworthy broker

- Register your binary trading account

- Deposit money or use the demo account

- Choose the asset to trade

- Make a forecast: Price up or down?

- Choose the expiration time

- Choose the investment amount

- Start the trade and wait till it expires

Let’s go into detail for every single step.

1. Find a trustworthy Binary Options broker

In the next sections, we will further explain to you how Binary Options trading works. But first of all, let’s answer the question of which broker is the best one to trade with. Not every online broker or Forex broker offers Binary trades so you have to look out for a firm that offers this financial instrument.

In the table below, you can see three of our most favorable Binary Options Brokers. These are brokers that fulfill many different requirements we set when testing all brokers. They are safe, give a high return to you as a trader, and are located all over the world. With every broker, you can open a free binary demo account to get started risk-free.

- Accepts international clients

- High payouts 95%+

- Professional platform

- Fast deposits

- Social Trading

- Free bonuses

- Min. deposit $10

- $10,000 demo

- Professional platform

- High profit up to 95%

- Fast withdrawals

- Signals

- $10 minimum deposit

- Free demo account

- High return up to 100% (in case of a correct prediction)

- The platform is easy to use

- 24/7 support

- Accepts international clients

- High payouts 95%+

- Professional platform

- Fast deposits

- Social Trading

- Free bonuses

- Min. deposit $10

- $10,000 demo

- Professional platform

- High profit up to 95%

- Fast withdrawals

- Signals

- $10 minimum deposit

- Free demo account

- High return up to 100% (in case of a correct prediction)

- The platform is easy to use

- 24/7 support

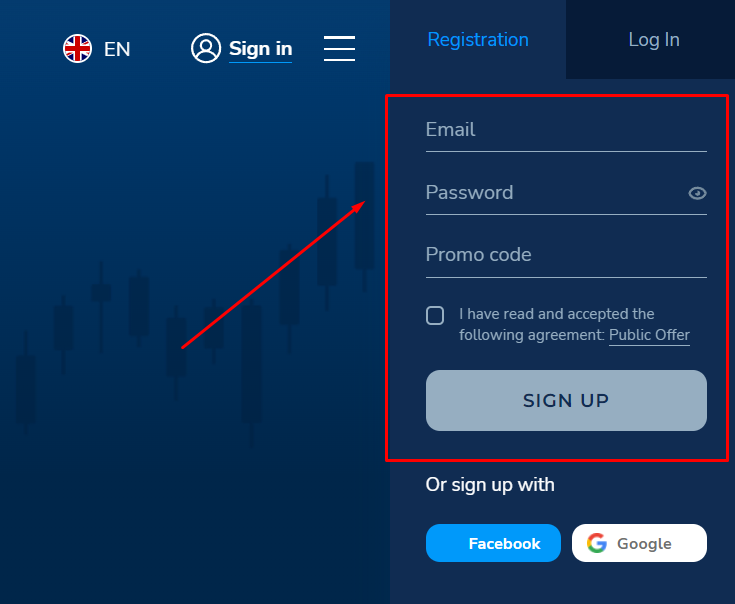

2. Register your trading account

After selecting your binary broker, you need to register for your trading account. You will need a secure email and a password. Moreover, you can mostly sign up via social profiles and networks.

(Risk warning: Your capital can be at risk)

3. Deposit money or use the demo account

Now you have 2 options: whether you use the demo account for practicing or directly start trading with real money. It is always recommended to start with the demo account because Binary Options trading is risky and you can lose your invested money very fast. Platforms allow you to switch between real and demo account within seconds.

You don’t know what a demo account looks like? They are retail investor accounts that have (mostly) all functions of a live account – but they have only virtual money in it which you can add for free any time you want.

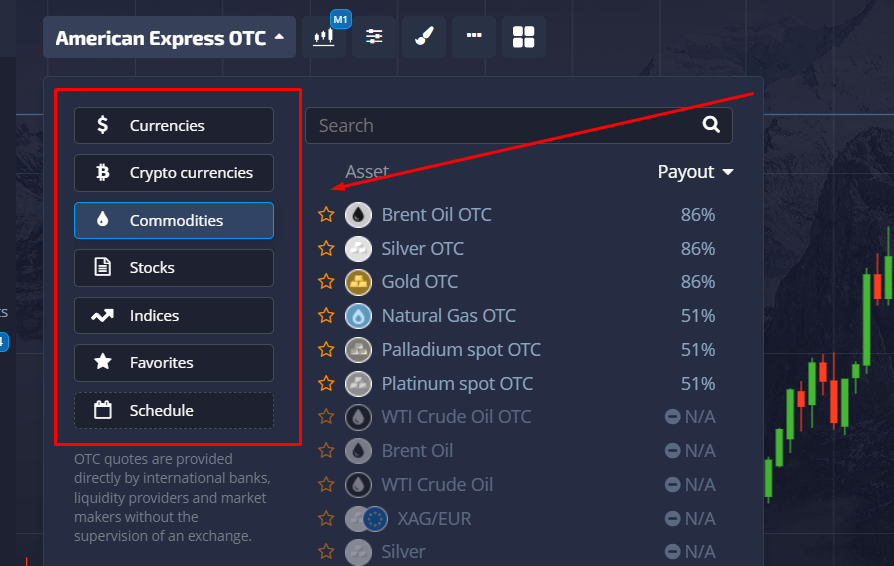

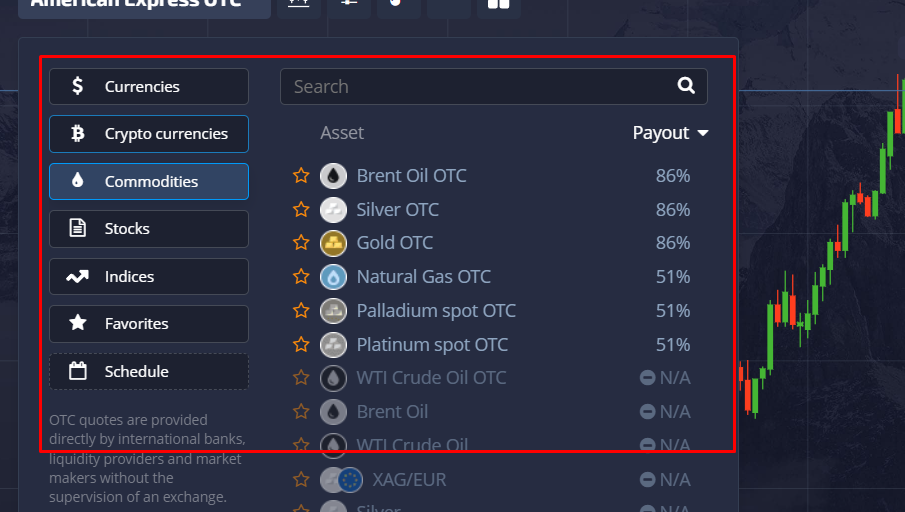

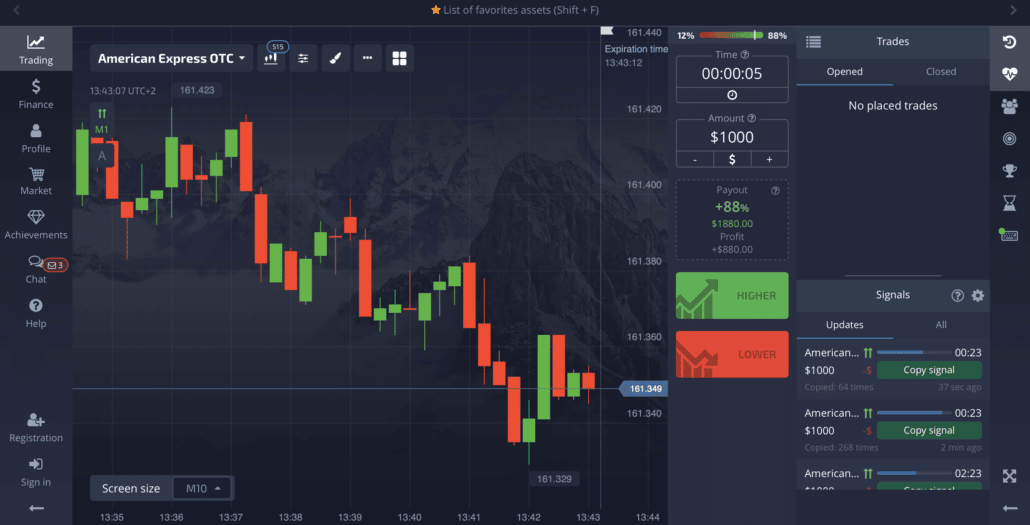

4. Choose the underlying asset

When you’re trading stocks, for example, you are limited to one asset. The good thing about Binary Options is that you are free to choose your underlying assets. You can choose between Forex market, Stocks, Commodities market with assets like gold or oil, Cryptocurrencies, stock index, and more.

No matter which asset you prefer, trading it via Binary Options always works the same way. The process shown below is always exactly the same. If you are new to trading Binary Option, we recommend you start with a practice trading account where you can trade and practice without risk.

(Risk warning: Your capital can be at risk)

5. Make a forecast with strategy – price up or down?

Once you have chosen an underlying asset or underlying market (for example forex market) you are ready to go. The main question is: Is the asset price going up or down in the future? You have to to this forecast. To get an answer to this question, you can have to identify the market trends and use indicators to analyze the underlying asset.

It is very important to have a right trading strategy to gain maximum profit. Use technical analysis to get trading ideas and develop your own trading strategy. You can also use the different education tools many Binary Options brokers offer.

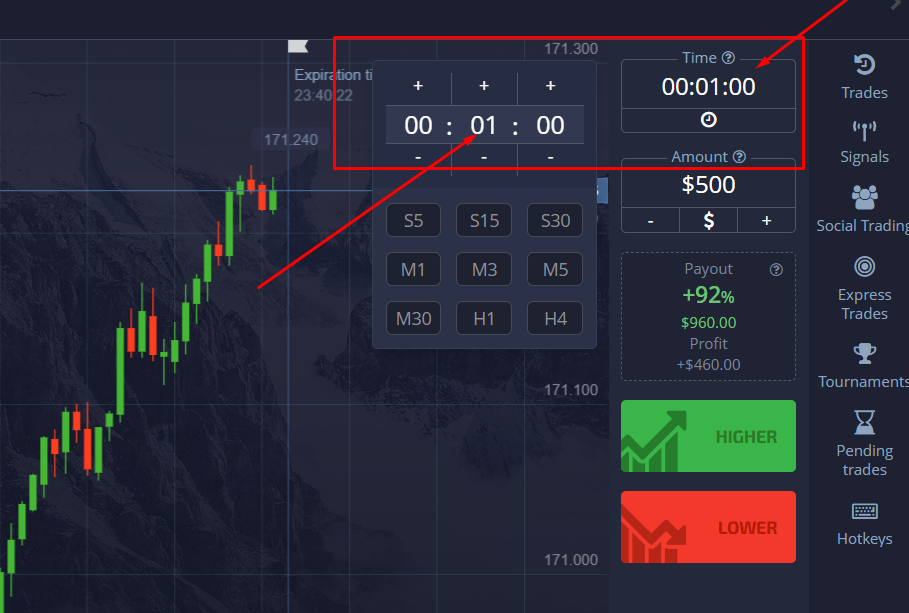

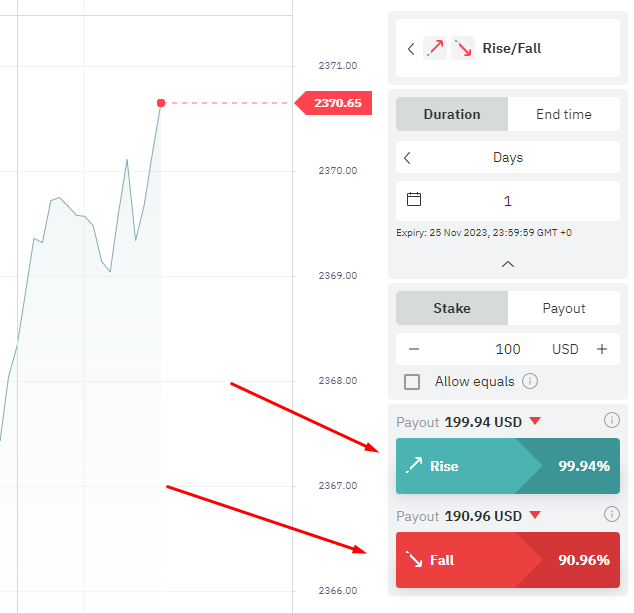

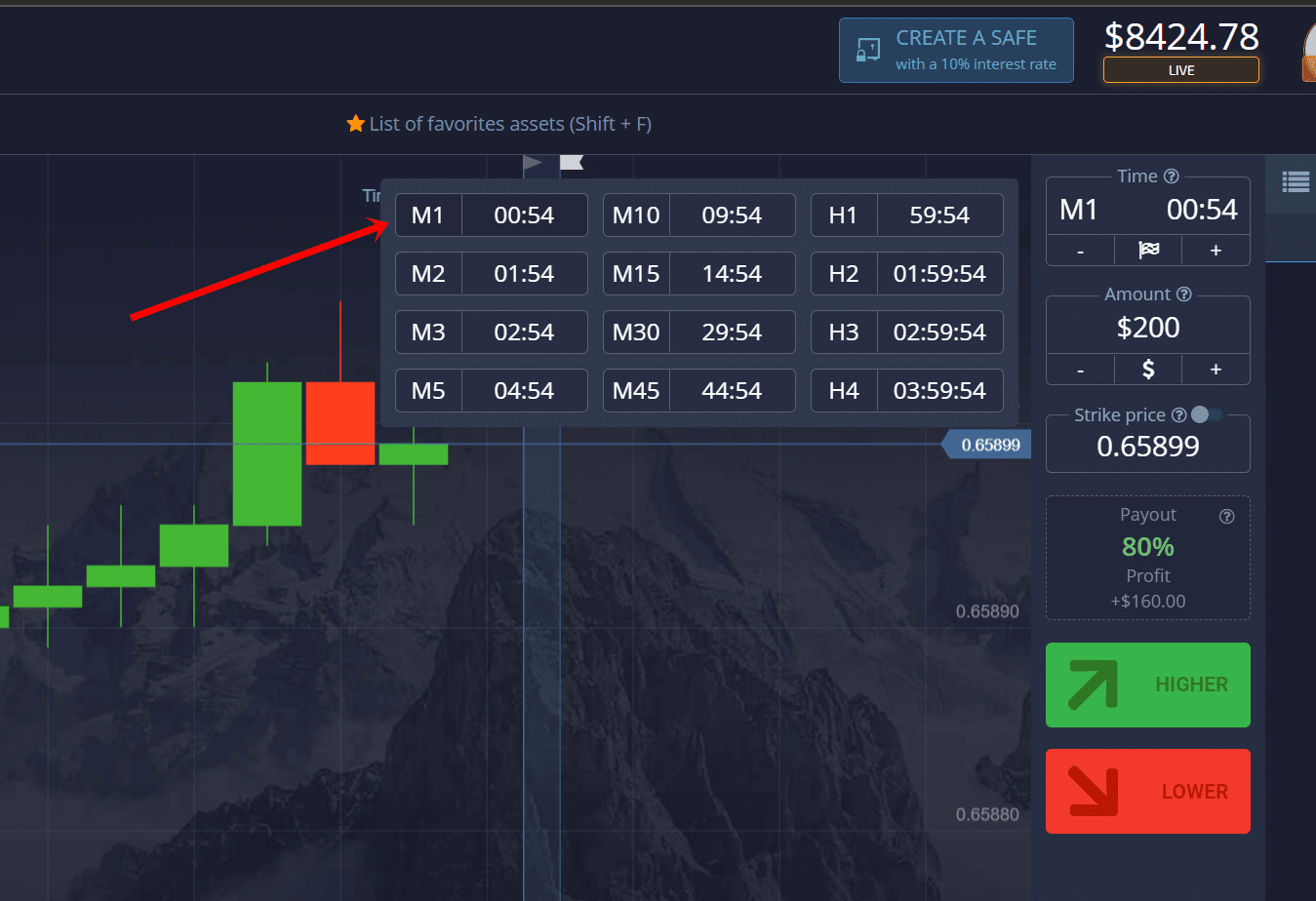

6. Choose the expiration time

Every Binary Option contract expires after a defined time (expiration date). So within your prediction of whether the market price will raise or fall, you have to consider the expiration time. You can set it in a range between 5 seconds or many hours, the choice is all yours. You see: It’s possible to trade long-term or short-term Binary Options.

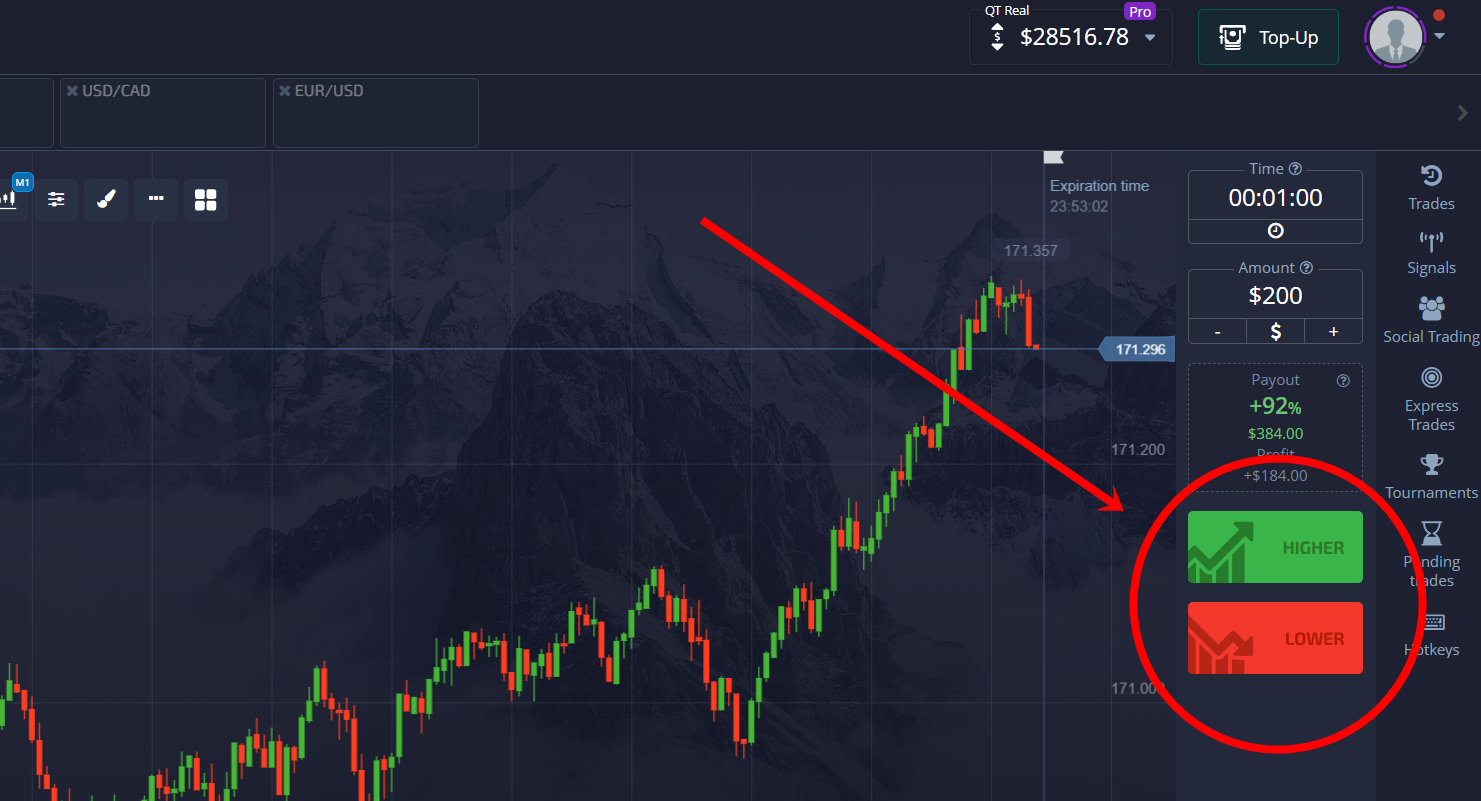

Once you decide on the direction – up or down – and the expiry time, you’re one step away from placing the trade. Just to remind you of the two options you have:

- Call (Higher): The price goes up in your expiration time

- Put (Lower): The price goes down in your expiration time

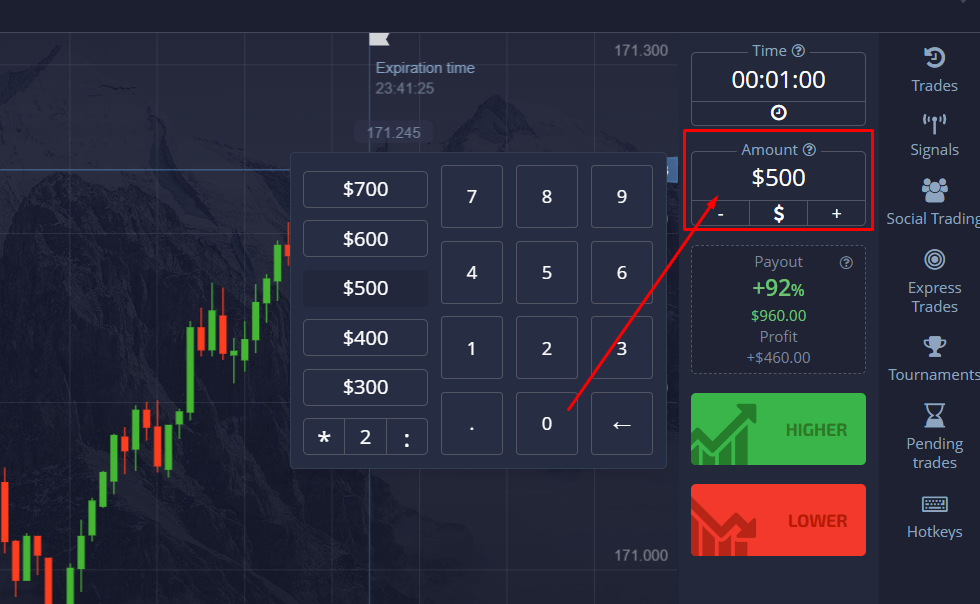

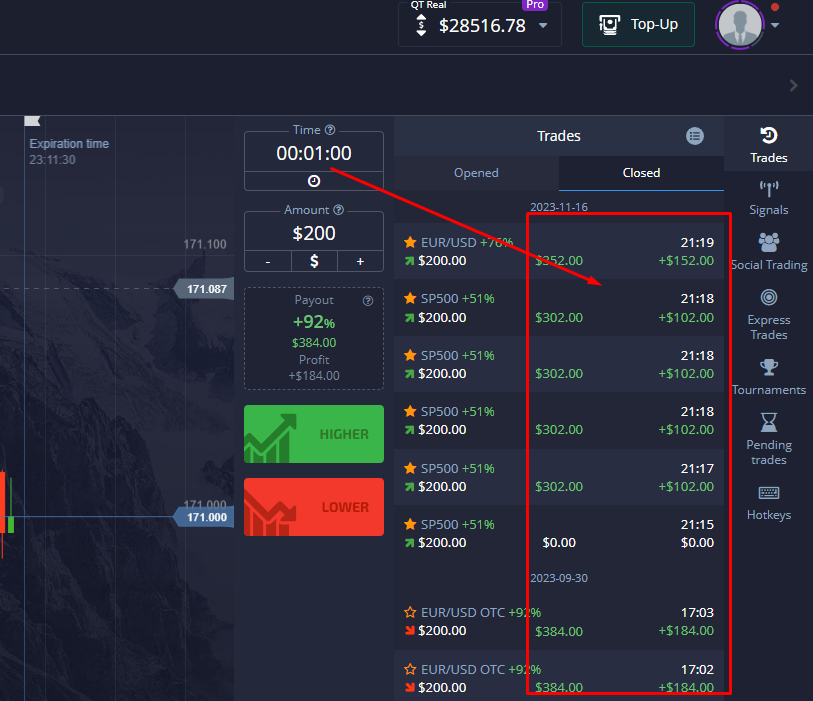

7. Choose the investment amount

The last step before you can place your trade is to set the investment amount. Some brokers limit this to a specific amount which often depends on your account level.

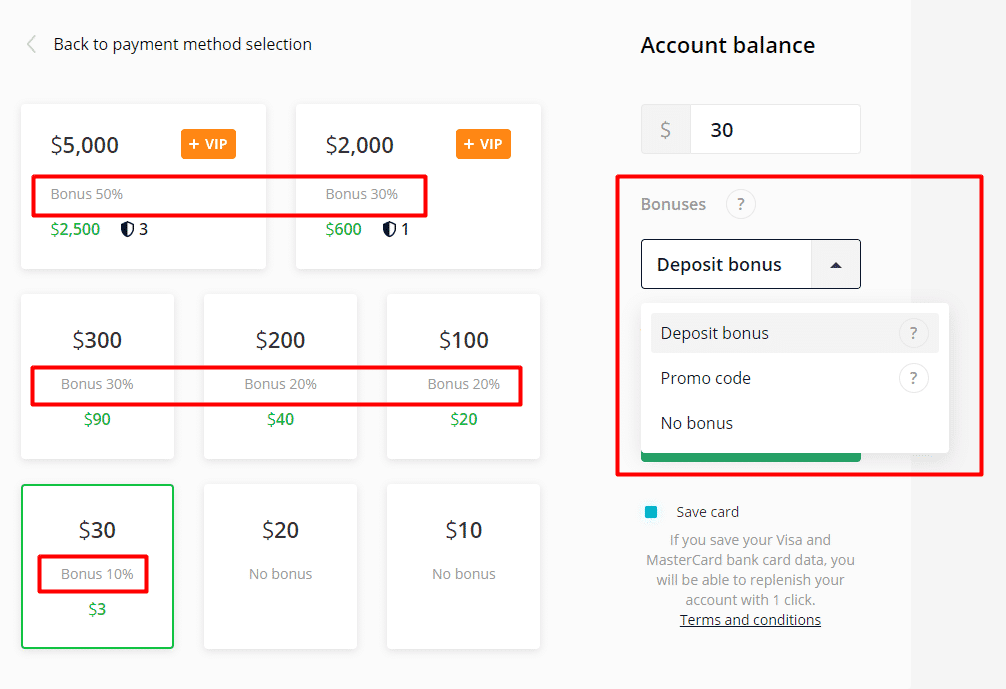

For example, if you have a beginner account you can only trade with $500. But with a VIP account, you can trade up to $5000 within one trade.

Be careful: Your investment is the amount of money you can lose. If your prediction is wrong, all of your money is gone.

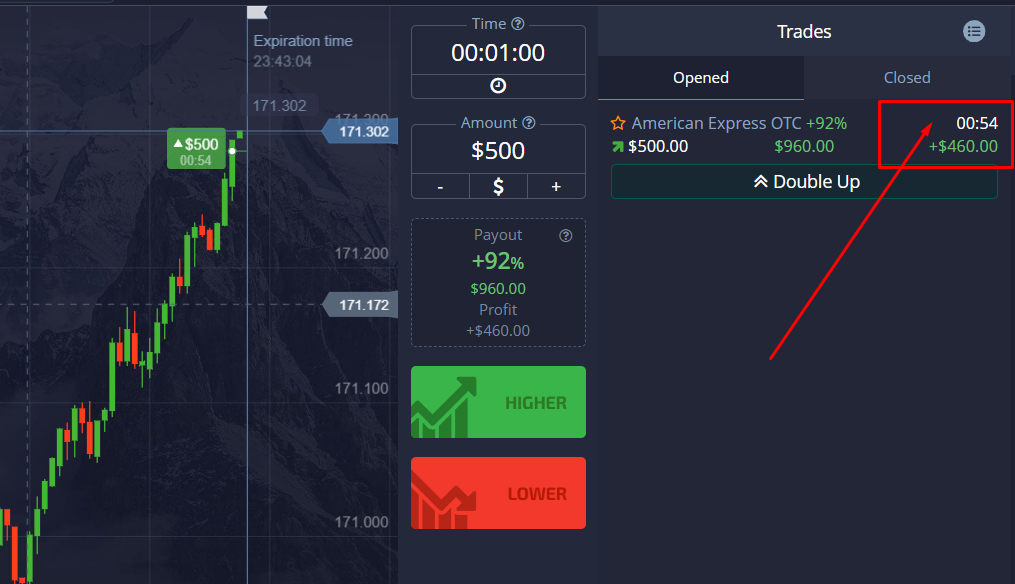

8. Start the trade and wait till it expires

If you set the investment amount, click Up / Call or Down / Put to place the trade. Some brokers want you to verify the trade, so you have to do another click. Now it’s time to wait until your trade expires. Some brokers offer to close trades before the expiration time is up – this allows you to reduce the impact of a wrong decision by closing the trade when it hits a certain price.

If you are right and the market price moves in the right direction below or up your strike price, you will get a payout between 75-95% of your investment. The yield depends on which broker and underlying asset you select.

(Risk warning: Your capital can be at risk)

Example of loss on Binary Options trading:

You will understand the binary options’ loss basics thanks to this example.

Suppose you have selected an underlying market where you wish to trade binary options. This market will allow you to choose your favorite commodities, indices, etc.

The binary option you choose to trade will have a strike price. It will also have an expiry time that decides whether you win or lose.

Depending on your preference, you choose a call or put option. Suppose the underlying asset’s strike price is $75. Your good judgment tells you the asset’s price will expire at a price higher than $75. Let us assume that you expect it to stop at $100.

At the expiry time, the underlying asset’s price stands at 0. Thus, the prediction that you went with to place this trade became worthless. Due to the loopholes in your research, you lose money and thus witness a binary options loss.

Example of profit on Binary Options trading:

The exact opposite will happen if you are right, and the price goes up to $ 100. Your strike price is $ 75, and now the price is above it. When the expiry time ends, you will have a profit from the yield of the binary option. An investment of $ 1,000 can be worth $ 1,800 with a yield of 80% on your Binary Options broker!

Basic terms used in Binary Options for dummies

When starting the trade in binary options, you will encounter many terms that you might be unfamiliar with but are important to make a successful trade. Here are the basic terminologies that every trader must know.

- Asset: One of the most used words in the trading world is ‘asset.’ It is that underlying stock, indices, commodities, or currency you choose to trade-in.

- Broker: It is the agent factor through which the deals are made.

- Expiration time: It is the date or time when the trade terminates.

- Financial instrument: A financial instrument means a contract with some monetary value and consists of a buyer and a seller.

- Fundamental analysis: These are the examination of assets based on geographical, political, and macro-economic factors.

- In-The-Money: Many brokers use this term to display the result of your trade. It means that your prediction stands correct, and you will get the return.

- Margin: In order to keep your spot open to the market, a deposit is required in your trading account, known as margin.

- Margin Call: It occurs when your account goes below the required maintenance amount of the broker. To avoid it, add extra funds to sustain the running losses.

- Strike Price: It is that rate at which the asset can be bought or sold, or at this rate, you can perform the call or put options.

- Out-Of-The-Money: It is the opposite of in-the-money. It is shown when the result is against your chosen option, meaning thereby, your prediction is wrong, and you have lost the money.

- Rate of profit: It is that percentage of return you will get after your correct call.

- Technical analysis: The examination of the market by taking note of previous trade records and price chart movement.

Binary Options trading: Is it safe or not?

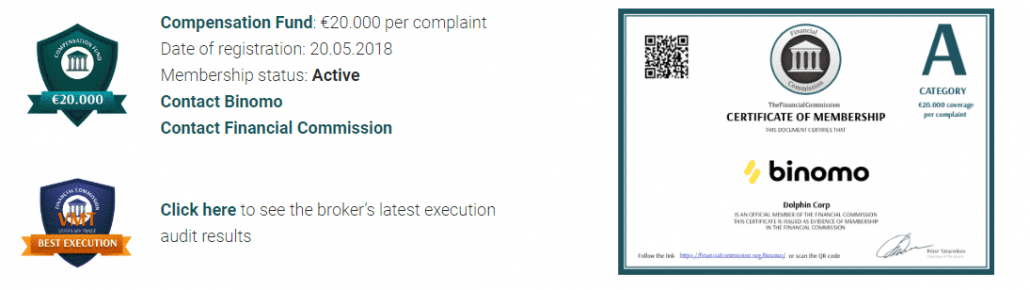

A very important question to answer is the safety of a financial instrument or a broker such as Nadex (North American Derivatives Exchange). Trading a Binary Option is safe, but you need the right broker. It should be reliable, trustworthy, and regulated. In our Binary Options Broker review we discussed the Pros and Cons of our ten favorable brokers, regulated and unregulated ones. Read the article to get into it in detail.

It’s safer if you trade with a regulated broker than a unregulated one!

We did a lot of research while writing all these articles and can say that a regulated broker never cheats on you as a client. To be fair: Most unregulated brokers don’t cheat as well. But it’s never 100 % safe with these mostly small and unknown companies.

So in conclusion, is Binary Options Trading safe? Yes. Use a regulated broker if you want to get started with Binary Options trading. Never trust blindly and do your own research before you register with a broker and deposit money. Additionally, you can rely on our information.

There are a handful of safe and well-known regulators. If your chosen broker is regulated by one of these companies and institutions, it’s a good sign:

- CySEC (Europe)

- The Financial Commission (International)

- Vanuatu Financial Service Commission (Vanuatu)

Also be aware if trustful institutions such as the Commodity Futures Trading Commission (CFTC), the National Futures Association (NFA), or especially the Securities and Exchange Commission (SEC) express concerns.

(Risk warning: Your capital can be at risk)

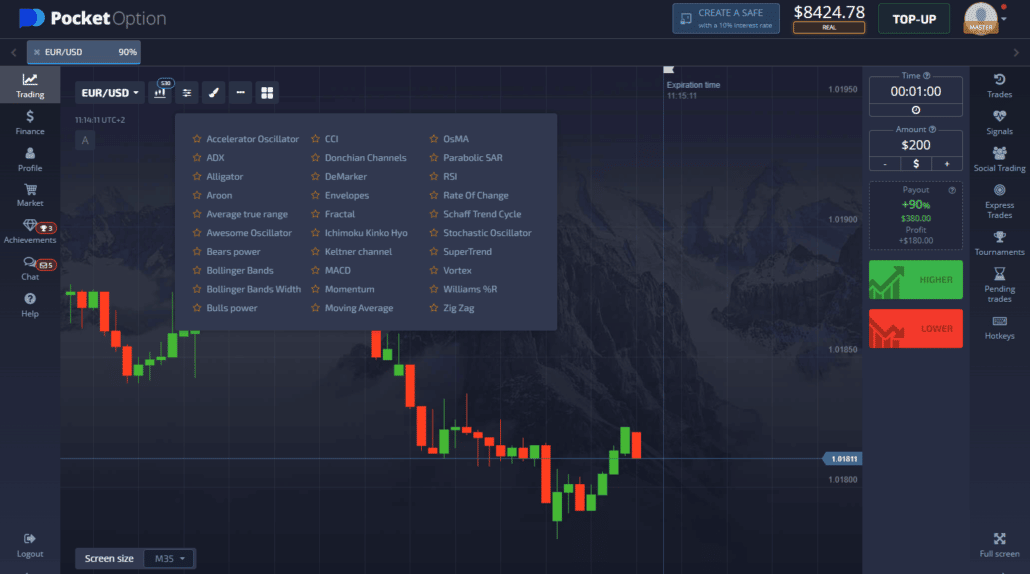

Binary Options platforms and brokers: How to use them

There are many Binary Options Platforms available, and you have to search for the one that is not only safe but also offers the functions you want to have to trade effectively. The good thing is that nowadays almost all brokers offer the same functions like mobile trading or modern and flexible charting software. The opportunity to trade via a mobile app is important if you want to trade wherever you are.

If you’re a beginner, it seems to be hard to learn how to trade Binary Options with a new and unknown platform. Many platforms offer so many functionalities that they can confuse you. But some of the brokers offer educational material as well. Video tutorials, step-by-step guides, or even individual customer support via mail, phone, or chat to answer your detailed questions.

Indicators and tools:

Every platform offers even a few indicators and technical tools, different chart types like the most common candlestick chart, and many more things to analyze your charts. Some brokers even give you free and direct access to economic news. You can use that to be up to date all the time and react to the news that impacts the assets you trade with.

One more word about indicators: They are very important when trading Binaries. We recommend you get familiar with the most important ones. Read the linked article to learn more about how to use MACD, RSI, etc.

(Risk warning: Your capital can be at risk)

Do Binary Options trading platforms offer mobile trading?

To react to the markets where ever you are you need a broker that offers mobile trading. So the only thing you need to trade is the internet. Mobile trading is a great opportunity to boost your profit, which binary options traders back in the day didn’t have.

Most brokers offer mobile trading, and plenty of them have developed a special app for trading on your smartphone. You can download it in the App Store (iOS) or the Play Store (Android). If a broker offers a mobile app, it normally does it for both common systems. This allows you to trade 24 hours a day, 7 days a week, no matter where you are.

Binary Options trading at the desk

But: Most of you, I’m sure, and that’s how I prefer it as well, better trade at the desk with your computer. Why? You have more tools to analyze the chart and a better overview if you have one or more monitors and not just your tiny smartphone display.

(Risk warning: Your capital can be at risk)

The conditions of Binary Options trading:

You are completely free to trade any underlying asset you can imagine – and your broker offers. No matter if you choose stocks, commodities, forex, or crypto, the process is always the same. Most of the brokers we tested give you the chance to trade more than 100 different assets.

The expiration time differs from broker to broker. But most of them offer expiration times from 5 seconds on. The upper limit is mostly one hour or three hours.

So the two main conditions are:

- Trade any underlying market you wish: stocks, forex, commodities, cryptocurrencies, and many more

- Choose between short-term and long-term time horizons (expiration times)

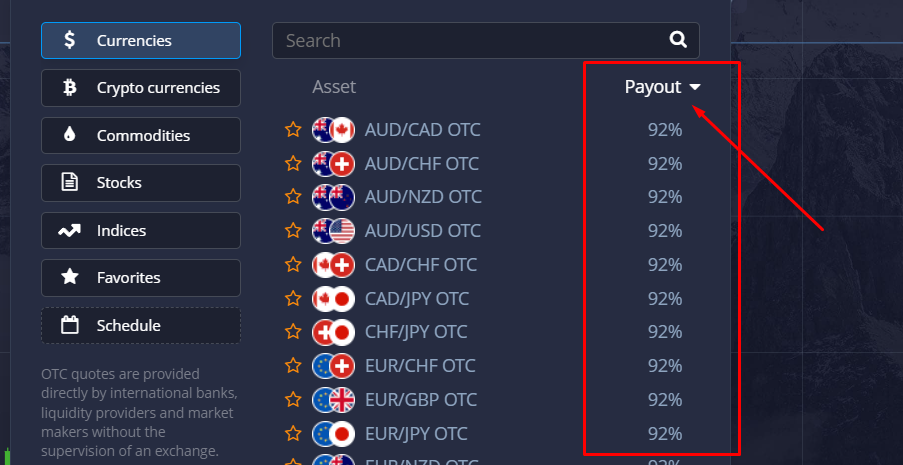

How high is the maximum yield (return on investment)?

Not every broker offers the same maximum yield (return on investment) for a specific asset. For example, broker A offers a 90% payout for Bitcoin, and broker B offers 85%. The better choice if you only want to trade Bitcoin is broker B.

The unwritten rule is that short-term trades have the highest payouts while long-term payouts aren’t that high. From my experience, the yield for standard accounts is between 70% and 95%.

But if you have a type of VIP account, you may have higher yields. Almost all brokers offer different account types that are linked to the amount of money you deposit. For example, if you deposit $3000 with IQ Option, you will get the VIP account status.

To attract traders and animate them to deposit more and more, you will get a higher payout with a better account level.

(Risk warning: Your capital can be at risk)

Trade types available in Binary Options trading

When the binary options were first introduced in the market, they had only one trade type, which meant the same. These were ‘High and Low’ / ‘Call and Put’ or ‘Up and Down.’

With the growth in the number of binary traders and its popularity, many other trade types were proposed. Here are some of the most used binary trade types.

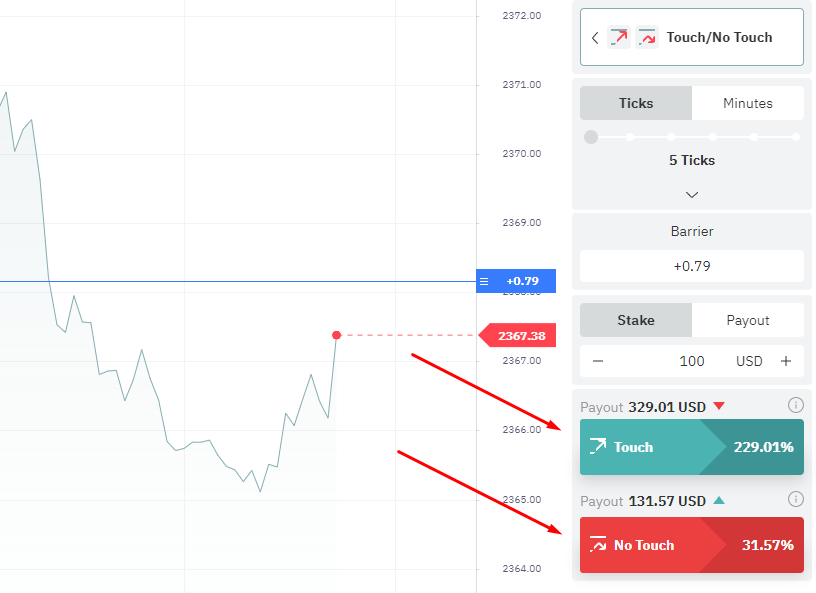

#1 One-Touch or No-Touch

In this type, you have three things to choose from. First is the asset in which you will invest your money, second is the price target, and last is the expiration time.

The price target can be set at any point but keep in mind that the farther the set barrier is, the more will be the return. If you set the target closer to the current point, which is easier to reach, the payout will be less.

If your asset reaches the set target point even once before the expiration time, you will get the profit. Before making a trade, two things are to be looked for-

- The reach of the price target

Set the price target diligently. It could be in any direction and, with careful analysis, judge the flow of the price. While setting, pay attention to the trade cost and payout value.

- The expiration time

All it takes is one touch to give you profit, even if the market goes in a different direction afterward. Many platforms offer expiration time up to days, so set the time you think is enough to reach the triggered point.

#2 High or low

The most used and popular type is choosing whether the asset will go high or low at the expiration time. Here, you have to examine whether the asset of your choice will end up above the strike price or not on expiration.

If you believe it will select high, and if not, select low. The time of trade’s termination can vary. This trade type is basic yet has its own risks. Therefore, before placing any trade, examine the price movements thoroughly.

#3 Range trades

It is also known as boundary trade. In this trade type, you choose an asset and trade within the range of two triggered points. If the price stays between the boundary until expiry, you will win, and you lose if it passes the range.

For instance, the strike price of an asset is $50, and you believe that it is going to go high up to $60. You trade in the range of $50 to $60. If the price of your asset remained between this boundary during the entire trade, you would get your profit. If it surpasses $60 or falls below $50, you will lose the entire investment.

#4 Short-term trading

Short-term or 60 seconds trading is used by many brokers, and seeing the upsurge in its popularity, many traders are inclined towards it.

It works like the high/low trade with an expiration time of 60 seconds. Some brokers in short-term trading also offer a trade termination time up to minutes.

#5 Long-term trading

The opposite of short-term, this trade type allows you to set the time limit up to days, weeks, or sometimes even months.

Most beginners prefer this type as in the short term the trade goes fast, and you have to be active and consistent all the time whereas, in the long term, you get more time to develop skills and study the charts.

(Risk warning: Your capital can be at risk)

#6 Pairs

As the name suggests, this trade type is performed in pairs. You have to choose which asset will perform better than the other at the expiry of the trade. You will gain the profit for your correct judgment, and for the wrong one, you will lose.

The pairing of currencies and stocks is very popular. For instance, in the EUR/USD, you believe that USD will go higher than EUR and place your bet. After the expiry, USD outperformed EUR, and because your prediction was correct, you won. In the opposite case where EUR goes above, you will lose.

Even if the pairing equally goes down, you will win as long as your asset has a higher value than the other.

#7 Ladder

In this type, the trade is broken into smaller portions which are then spread over different intervals. Each time when the strike price touches the triggered point, you will receive a partial bonus.

Your trade is divided into different strike prices with varying times of expiration. When you reach the first interval, you will receive some profit and so on.

For example- you are ladder trading the currency pair of USD/EUR, which you believe will go high. At noon, the value of your asset is $60. You chose three-strike rates and three different expiration times.

- 1st strike is set for the value of $60.85 with a payout of 40%; the expiration time is 12:20 pm.

- 2nd strike is set for $70 with a payout of 55%; the expiration time is 12:40 pm.

- 3rd strike is set for $70.45 with a 70% payout; the expiration time is 01:00 pm.

To win this bet, USD/EUR must reach $60.85 or above at 12:20 pm. If it happens, you will get the 40% payout, and subsequently, for every rung you climb, you will receive the mentioned profit.

Remember that the payout value will change according to the difference in the intervals. If the gap in the strike prices is small, you will get less payout because it involves less risk, and for a large gap, the profit will increase.

Risks of Binary Option trading explained:

No doubt – Binary Options are a risky financial instrument. Nevertheless, there are many advantages that overweigh the risks. Many new traders fear the loss of all of the money they invest in one trade. Sure, you can lose all the money you placed in your trade – but not more. Many other financial products work another way, where you can lose more than you have invested.

There are a lot more advantages, for example, that you get a high asset payoff no matter how strong the binary options trading market reacts and moves. The price of your chosen asset just has to go up or below your strike price and you win. Many traders including us like this financial product because it’s easy to understand and you can make a lot of profit in a short time.

Only invest money which you can afford to lose!

Binary Options trading: How to get started

If you want to start Binary Option trading now, there are a few things you need to know and answers that may come up. We try to answer all of them and give you all the information you need to get started. This section is less about how to trade Binary Options but more about the things besides the Binary Option themselves.

(Risk warning: Your capital can be at risk)

Should you use a Binary Options demo account or not?

Many of you ask us if it is necessary to first trade via a demo account or not. Our clear answer is: Yes, it’s necessary. With a demo account, you can learn how the market moves and how your chosen broker works. Almost all of the reliable brokers offer a demo account with virtual money that you can top up with just one clock.

Learn about your Binary Option trading platform before you invest your real money. You can also try out new strategies or form your own, individual trading strategy through a demo account.

- First: demo account.

- Second: Strategy.

- Third: Real account.

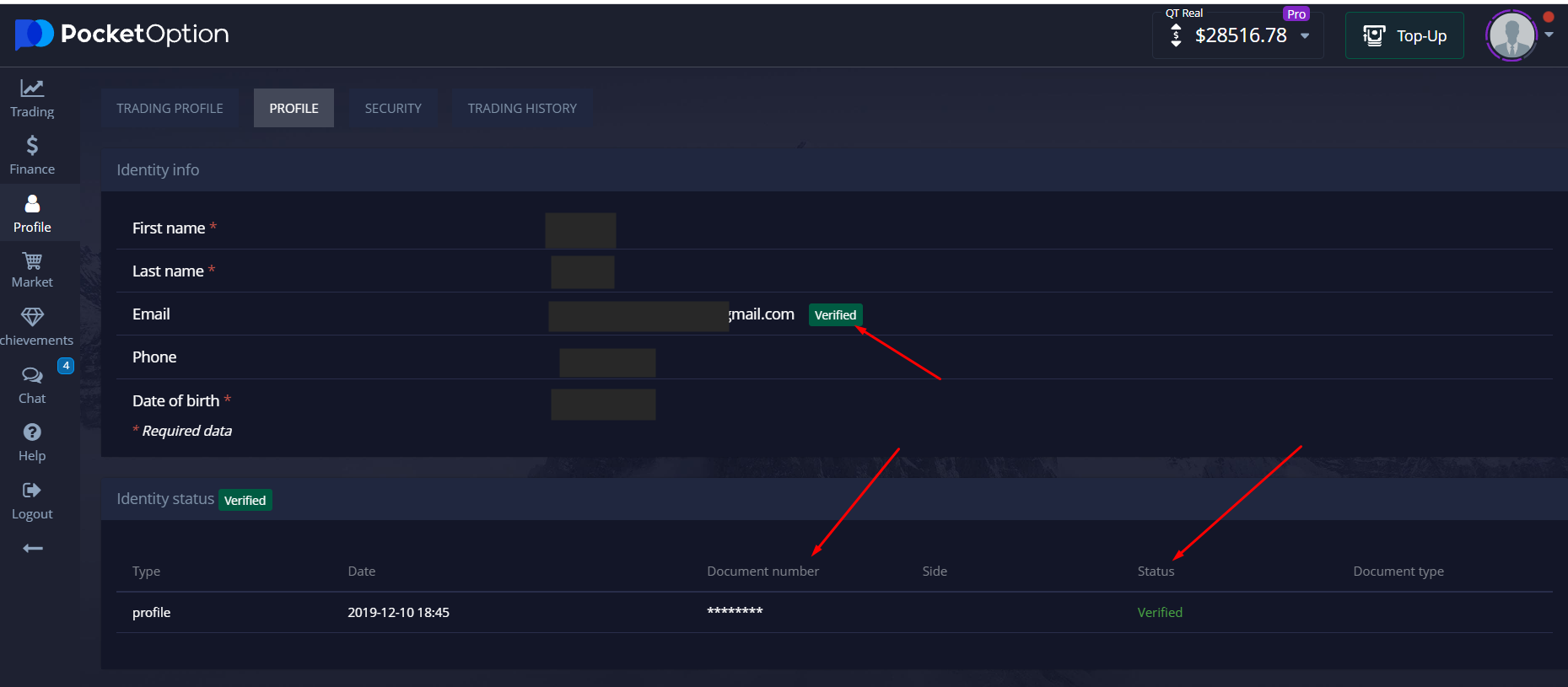

How to open your first real account

You must fulfill different criteria once you’re ready to open your first real account. On most trading platforms, you can trade without verifying your broker account. But in our opinion, you should do the verification before getting started, so you have unlimited access to all functions and deposit and withdrawal methods.

For the verification process, you need your real personal data (full name, birthday, address, mail, phone number) and some personal documents. You have to upload for example a copy of your passport and a utility bill or similar. You have to do this to prove that you are a real person.

The verification process only takes 24 hours in most cases. Some brokers – not many – don’t want to see any documents or verification.

How much money do you need for trading Binaries?

The answer to this question depends on how you are willing to invest. Always stick to your risk and money management. Many brokers offer low deposit minimums. For example, Quotex or IQ Option enables you to start trading with just $10.

The upper limit is almost endless. From my experiences in the past years, it’s possible to earn a lot of money with the right trading strategy. So it’s not necessary to invest all your money when getting started. Just start slow and if your strategy turns out to be tremendous, deposit more.

How much risk per trade?

The term “how much” refers to several factors in the binary options trading field. It denotes risks, effort, time, and money. It is always safe to risk not more than 1% of your funds per trade. You can protect your capital by reducing your trading risks. You will lose a small part of your capital even if you lose trades through many mistakes.

First, you need to set up the percentage of your trading capital that you will be willing to put your money on the line on one binary options trade. The ideal percentage must be 1% or 2% of your trading capital. You can go up to 5%, but it is not safe on all occasions.

It is determined by the kind of binary options deal. This 5% risk will give a greater position size to you for standard binary options trades. You can then calculate the number of contracts you can take. You need to calculate contracts to allow you to remain within the limit of your risk.

- A high risk of up to 10% of the trading account can result in a fast account blow up

- Always trade with limited risk, like 1% of the trading account per trade

- A limited risk will remove your emotions while trading

(Risk warning: Your capital can be at risk)

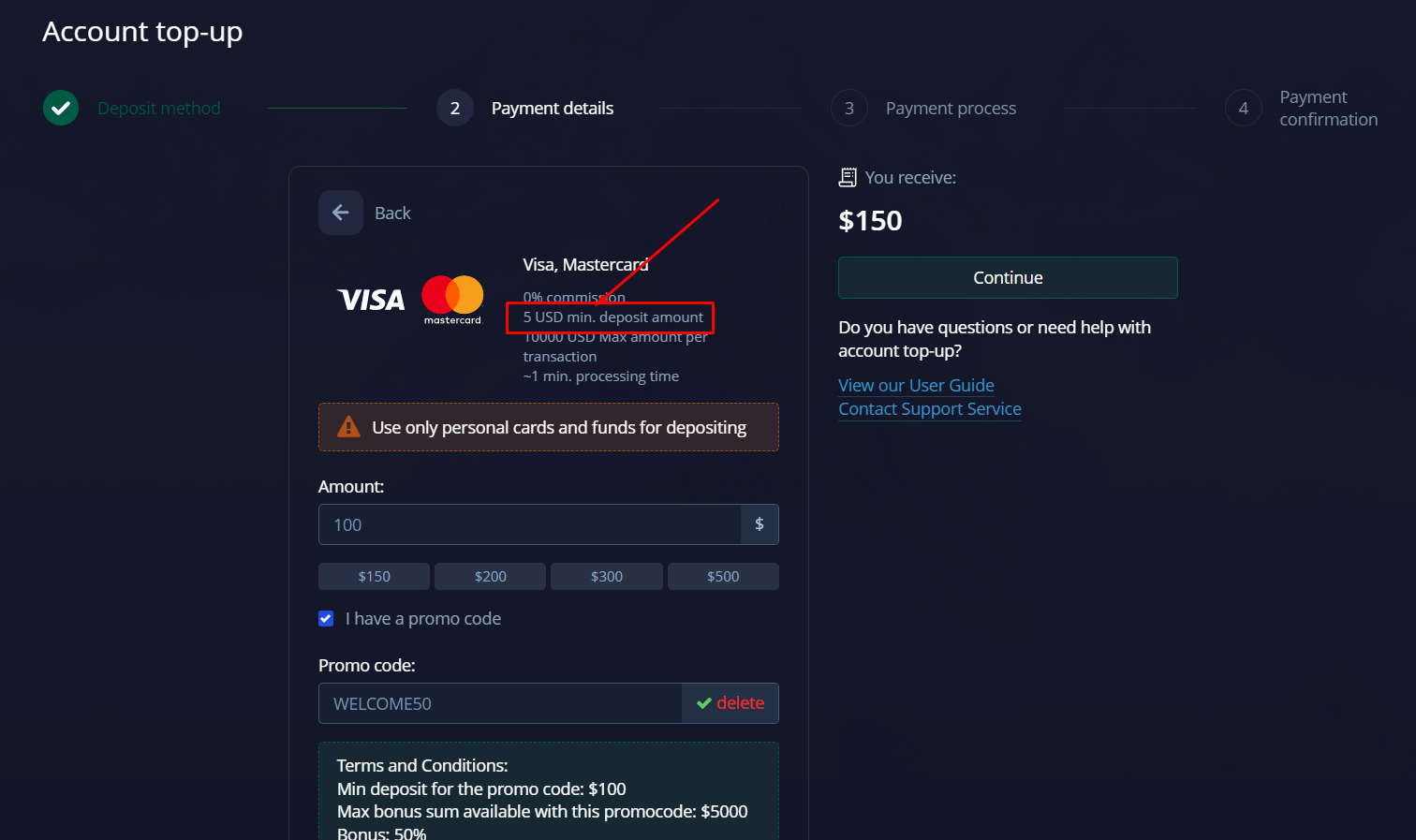

All about deposit and withdrawal methods:

Maybe you already asked yourself which payment methods are available when trading Binary Options. In the past, many brokers did only offer some special payment and withdrawal methods. Nowadays, the market is user-friendly and brokerage firms offer many different payment methods.

Facts about the deposit

- Many platforms offer a minimum deposit of $10

- Minimum trade amount: $1

- High amounts can be traded as well

- The minimum deposit for a Binary trade depends on the broker

Deposit and withdrawal are easy. Most brokers do not offer any fees for depositing or withdrawing your funds. Many of them offer up to 20 different payment methods. It’s possible to capitalize on your trading account within seconds. The withdrawals last a little bit longer, up to 24 hours.

Some of the major payment methods Binary Options brokers offer:

- Bankwire

- Credit Cards (Master/VISA)

- Cryptocurrencies (Bitcoin, Ethereum, Ripple, and more)

- E-Wallets (Skrill, Neteller, FasaPay, ePayments, Yandex, and more)

Are there bonuses for deposits?

To attract new customers, almost all Binary Option brokers offer a free bonus when you top up your account the first time. Some brokers even offer a bonus every time you deposit money. In both times, it can vary from 10%, 20%, 30%, 50% up to even 100%.

In other words: Some brokers double your amount of money.

Be aware of the fact that the bonus isn’t completely free. In most cases, you have to reach a certain turnover with the bonus before you can withdraw your funds. For example, you need to make a turnover of 30x the bonus you got. The bonus isn’t mandatory. So if you’re not good with the conditions, turn it off.

Get a free deposit bonus of 50% at Quotex with our promotion code “bobroker50“

You can only use this bonus code by signing up via our website.

(Risk warning: Trading involves risks)

How much money can you earn by trading Binary Options?

It’s up to you, how much money you will earn by trading Binary Options. The key to your successful career as a trader is a good education, risk management, and a professional strategy. Also, your money management has to be good.

At first sight, it is easy to make money with Binary Options. But if you’re getting more into it, you will experience that the markets, especially for beginners, aren’t that easy to understand. We are sure, that your success won’t come immediately.

It’s normal that it takes some time until you see progress and the winning rate of your trades gets higher and higher. The more trading decisions you make, the better you get.

Let us give you some more insights into four specific topics that are directly linked with your success as a Binary Options trader.

Education

It’s the most important rule for beginners: Educate yourself before getting started. Use the educational sections most of the Binary Options brokers offer. Use websites like ours, and YouTube videos, and read books to learn about trading and the financial markets. Use technical analysis tools to boost your trading skills. And of course trade via the practice trading account to learn the mechanisms of the markets and assets.

Strategy

Once you know the theory about trading and Binary Options it comes to real trading and you will see: It differs a lot from the theory. Trading a Binary Option requires analyzing charts, fundamental analysis, and a feeling for the markets and assets.

So develop your own trading strategy, otherwise, you will blow up your account. Use the knowledge of our website as a base and create your own strategy for each Binary trade.

Here are some of the main trading strategies that you can have a look at and use for your next Binary Options trade:

- 60-second strategy

- Candlestick pattern strategy

- Next candle prediction strategy

- MACD strategy

- Fibonacci Retracement strategy

Money Management

Many of the retail traders I know had to learn how real money management works. That’s why we recommend getting familiar with it before you start trading.

In my personal opinion, never use more than 0,5 to 3% of your account balance for one trade. Even if you have bad luck and a losing streak, it won’t get you down. If you stick strictly to your money management, you can trade without emotions.

Signals

Have you ever heard of trading signals? Professional traders offer trading setups and signals that you can copy. If it is a reliable trader, you can trust him or her. But be careful: There are a lot of scams and unsuccessful signals.

Tax

When you earn some profits on the financial markets, most of the time you have to pay capital gain taxes. The Binary Options tax rules are different from country to country, but you should definitely take a look at it if you do financial transactions. We recommend visiting your local tax lawyer to check the taxation on Binary Options. From our experience, the tax rate can be from 0% up to 30% or more on capital gains.

Conclusion and checklist: How to trade Binary Options with simple strategies

You have to be aware of scams in the Binary Options market. But the financial instrument itself isn’t a scam. It gives you the chance to invest in short-term or long-term opportunities in the market. Therefore you can select any asset you want and the functionality of a Binary Option is easy to understand.

My honest advice to you as a professional trader: It is very important to choose a good and reliable broker. Don’t register with the first broker that comes to mind. Check reviews, the Securities and Exchange Commission (SEC), and make sure, it’s not a scam!

Watch out for this short trading checklist for beginners:

- Select a trustworthy broker

- Register and verify your account

- Use the demo account to get into it

- Deposit money and switch to the real account

- Choose an asset or market to trade

- Analyze the chart

- Forecast the price movement (up or down)

- Choose the expiry time (short-term = higher payout)

- Set your investment amount

- Place the call (higher) or put (lower)

- Use a trading journal, especially if you’re a beginner

With this little checklist, we have shown you everything you need to know about trading Binary Options. We wish you the best of luck and happy trading!

(Risk warning: Your capital can be at risk)

FAQ – frequently asked questions:

Can you really make money with Binary Options?

Yes, it’s possible to earn money with Binary Options. But be aware: 80% of traders lose their money. To belong to the other 20%, you need a working trading strategy and sensitive money management. Do not trade too much multiple contracts and use too much capital for one trade.

What are the best brokers to learn Binary Options?

First of all, get familiar with the financial instrument and your chosen broker via using a demo account. After you developed your own strategy and feel comfortable with your decisions, switch to a real account. Common online trading platforms are Quotex, IQ Option, and Pocket Option.

How do you master Binary Options?

It is important to understand how the market goes. Therefore you have to develop a trading strategy, learn the technical analysis and use indicators to analyze the chart of an asset. Use books, videos, our website, and many more educational tools to get into Binary Options trading. The learning process never ends.

Are Binary Options a good investment?

When you understand, how Binary Options work and created your promising trading strategy, Binary Options are a good investment, just like better-known Forex trading for example. But be aware that it isn’t risk-free.